Is the Age of Magic Money Ending?

- THE GEOSTRATA

- May 1, 2022

- 4 min read

Updated: Oct 31, 2022

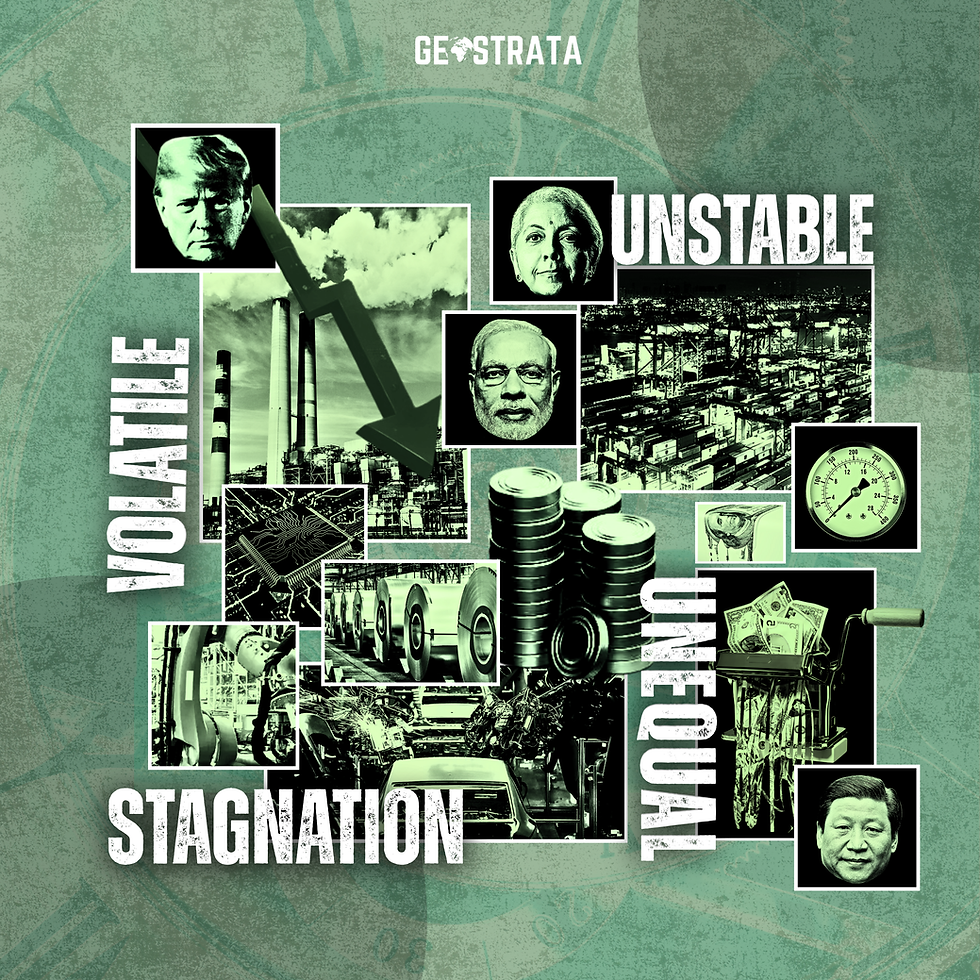

Image Credits: Graphics Team Strata

In the past couple of years, advanced economies seem to have entered a new age: the age of magic money. Simply put, this refers to the practice adopted by central banks of advanced economies that seem to be printing money out of thin air, with little to no negative repercussions. This was primarily because of the dormant inflation in advanced economies, which allowed the central banks to increase the money supply and provide money directly in the hands of people with no significant consequences as the increase in money supply drove the interest rates low. While the magic money thesis resulted in wonderful economic consequences, it seems that it is in jeopardy as its very premise, dormant inflation has been thrashed.

Magic money led to a series of positive consequences for the economy. The response of advanced economies to the Covid-19 pandemic has been very successful. The US government steadied its economy by running budget deficits worth a combined 27% of one year’s GDP, which was far more than the cumulative 18.5% in 2009-10, following the global financial crisis of 2008.

The result of the stimulus packages announced by the United States government, which directly put money into the hands of consumers, is that wages are up, consumers are richer, businesses have more cash on hand and the real GDP is higher relative to the eve of the pandemic. The output of the economy recovered very fast. The recovery from the slump induced by the lockdowns announced due to the pandemic has been unprecedented. Other advanced economies like Japan, the United Kingdom, and a few countries of the European Union have had the same experience.

Yet the economic theory of magic money seems to have faced a snag along its relatively smooth journey. Inflation has been stubbornly high for the past few months now with the Federal Reserve with the core inflation rate reaching a whopping 6.5%. It might be difficult for Indian readers to understand the significance of this number, so let us have a brief look at the history of the US inflation rate in the past 3 decades.

The US has seen dormant inflation since 1998 with the core inflation rate being near about 2% throughout this period. Things began to change during the pandemic, partly due to the supply chain disruptions and partly due to the increased demand from consumers as a consequence of the stimulus packages announced by the US government to combat the pandemic. Some economists, therefore, argue that high inflation means the end of the age of magic money.

Image Credits: Bloomberg

This might not be entirely true. Many economists believe that the current high inflation rates are temporary. It is believed that in the short term things are much more likely to get worse before they get better. This is due to the shortage of semiconductors, housing space, and energy, which is likely to put more pressure on price. However, an increase in prices due to supply constraints seems to be temporary as supply chains restructure themselves and production bottlenecks clear with more people getting vaccinated and rejoining the workforce.

A similar situation is expected to play out on the demand side as well. At present, the stimulus packages announced by the government have resulted in consumers having increased purchasing power which has led to very strong demand. On the other hand, with the supply being curtailed, the result is that there is high demand and low supply, causing an upward pressure on prices to rise. With the government stimulus drying up, demand is expected to calibrate as the consumers run down their financial reserves. This, along with an increase in supply as the world puts behind the effects of the pandemic, will ease the current pressure on prices. The service sector should be able to absorb some of the current demand and be back to normal. If this situation unfolds, magic money would have been extremely successful.

There is, however, a darker scenario that may play out. If people come to believe that inflation is here to stay, workers may push for higher pay to be able to cope with the rising cost of living. The businesses, on the other hand, are likely to simply pass on the burden back to the consumers by further raising the prices. It is not clearly understood how people form inflation expectations, so it is hard to understand the risk. The state of the financial markets has created another risk.

Due to the low yield from bonds, Investors focused their investments into the stock market, arguing that there was no other real alternative investment opportunity. This has caused stock prices to jump up heavily in the past 2 years and they are also way above the long-term average. Crypto assets and housing prices have also followed suit. If inflation continues to remain high, the Fed may have no other option but to hike up the rates which could trigger a financial burst, which is a serious threat to the entire global economy.

Image Credits: ALJAZEERA

The situation is still playing out and only time will tell whether the age of magic money is truly over or whether it will continue. If inflation rises and the Fed increases the rates leading to a financial burst, then indeed it might be the end for magic money. It will expose the risks of budget stimulus. If supply stabilizes and demand subsides, then inflation will stabilize at approximately 2% or a little higher. Higher inflation and interest rates will also be good for the economy. It will mean that the fear of secular stagnation, the fear that the economy can grow only at interest rates close to zero will have been relieved. Higher interest rates will also discipline borrowers and make the financial system more resilient and less prone to financial bubbles.

———————————————

BY PRANAV ANAND

TEAM GEOSTRATA

anand.pranav20@gmail.com

.png)

Choosing a residency more than required can bring down your EMI esteem yet increment your general interest installment. Choosing a residency too short can diminish your net interest installments however will build the EMI esteem coming down on your financial plan. Consequently, 2 wheeler loan pick a residency solely after going through a purposeful estimation and examination of your funds.

Shared (P2P) loaning is a type of monetary innovation that permits individuals to loan or get cash from each other without going through a bank. P2P loaning sites interface discover more here borrowers straightforwardly to financial backers. The site sets the rates and terms and empowers the exchanges.

Very well written!